Middle Market CLOs: Proven Stable Performance in Volatile Credit Markets

Estimated reading time: 3 minutes

Since the 2008-2009 Great Financial Crisis, U.S. companies and the U.S. economy have prospered, primarily due to robust capital market liquidity, low inflation, and historically low interest rates; these factors led to extremely low levels of credit defaults in the loan markets. This stable performance, coupled with outsized returns for non-investment grade corporate loans relative to other credit asset classes, has attracted increasing levels of investor dollars. The strong loan credit market has, in turn, contributed to strong investor interest in both the broadly syndicated loan (BSL) and middle-market (MM) collateralized loan obligation (CLO) fund markets.

Historical data shows that CLOs, as an asset class, performed exceptionally well through the Great Recession and through the August 2011 U.S. credit rating downgrade with very low defaults overall. S&P published a study in 2014 looking at 6,100 rated CLO tranches in 1,100 CLO vehicles from 1994 to 2013, which showed only 25 tranches defaulted, or a 0.41% default rate. Of the 25 defaults, only eight were investment-grade tranches (0.15%), and 17 speculative-grade tranches defaulted (1.78%). Almost all defaults occurred during the Great Recession, and no AAA or AA tranches defaulted. In January 2022, Bloomberg published a more current study showing since 2010, only five defaulted securities across 11,400 securities in 1,300 U.S. CLO vehicles.

The stability and popularity of CLOs continued increasing annually, with growth materially increasing in 2017 and beyond. Driven by the growing popularity of the CLO asset class, MM CLOs began to garner more interest around the same period. Based on Leveraged Commentary & Data (LCD) data, there have been over 150 new MM CLO issuances since 2017, compared to 69 in the five years prior.

More recently, CLO performance also proved resilient after the most recent 2020 pandemic-induced shutdown. Despite a material slowdown of new issuance CLO volume following the onset of the pandemic in early 2020, a record number of leveraged loans and CLOs were issued in 2021. U.S. CLO issuance reached an all-time high of $187 billion in 2021. Similarly, middle-market CLO issuance also displayed record volume. Per LCD, 41 new middle-market CLO transactions totaling approximately $22 billion closed during 2021.

Since its emergence as an asset class 25 years ago, CLOs have weathered all economic cycles, especially CLO 2.0 structures and MM CLOs. This can largely be attributed to stricter covenant tests, more restrictions on junior asset portfolio allocations, and tighter restrictions surrounding reinvestment periods vs. pre-Great Recession CLO 1.0 structures.

Although the recent pandemic was feared to be catastrophic to middle-market companies, many persevered and thrived throughout the crisis, as newly-formed MM CLOs were agile enough to avoid those industries most severely impacted, while existing MM CLO managers were effective at managing credit risk from existing portfolios. To manage liquidity, many middle-market issuer companies obtained Paycheck Protection Program funding, reduced cash interest payments, opted for increased payment in kind interest, pushed back scheduled amortization payments, and extended maturities.

Furthermore, as most middle-market issuers are private equity-owned, the private equity control groups were supportive with necessary liquidity and growth capital throughout the crisis, bolstering the balance sheets of middle-market companies. Additionally, many lenders showed a willingness to waive financial covenants for several quarters and execute amendments, helping to keep many middle-market loans out of technical default. Middle-market CLO managers also benefitted from wider stress tolerances inherently built into MM CLO structures (higher CCC/Caa rated tolerances) that allowed managed MM CLOs to absorb ratings shocks more readily than some of their broadly syndicated loan CLO counterparts.

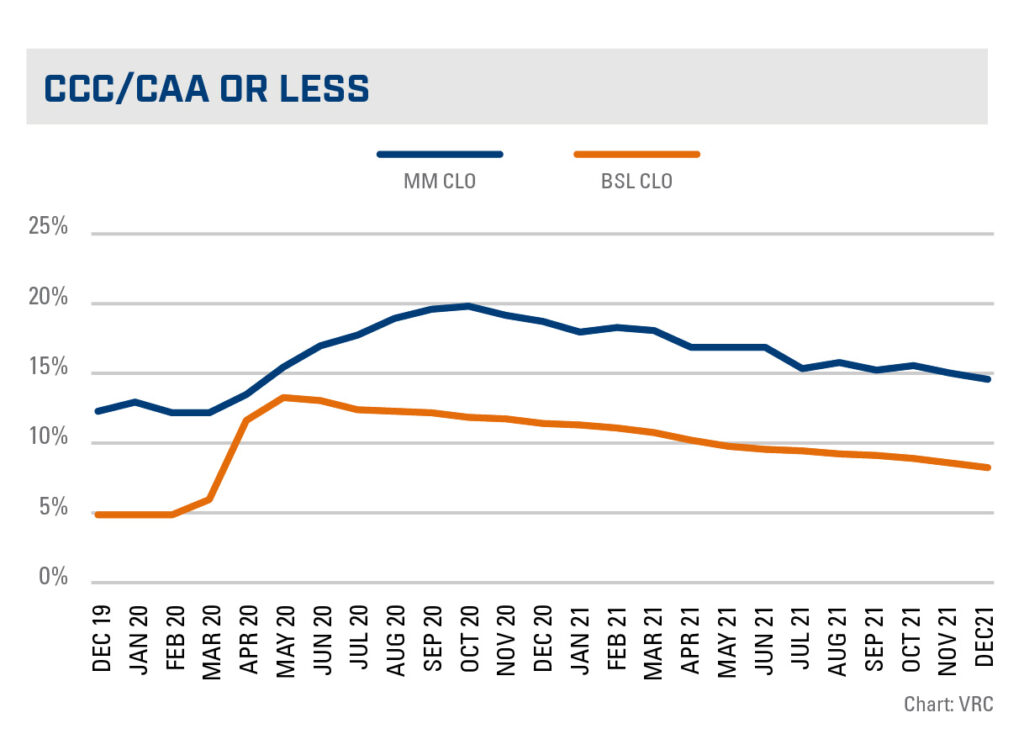

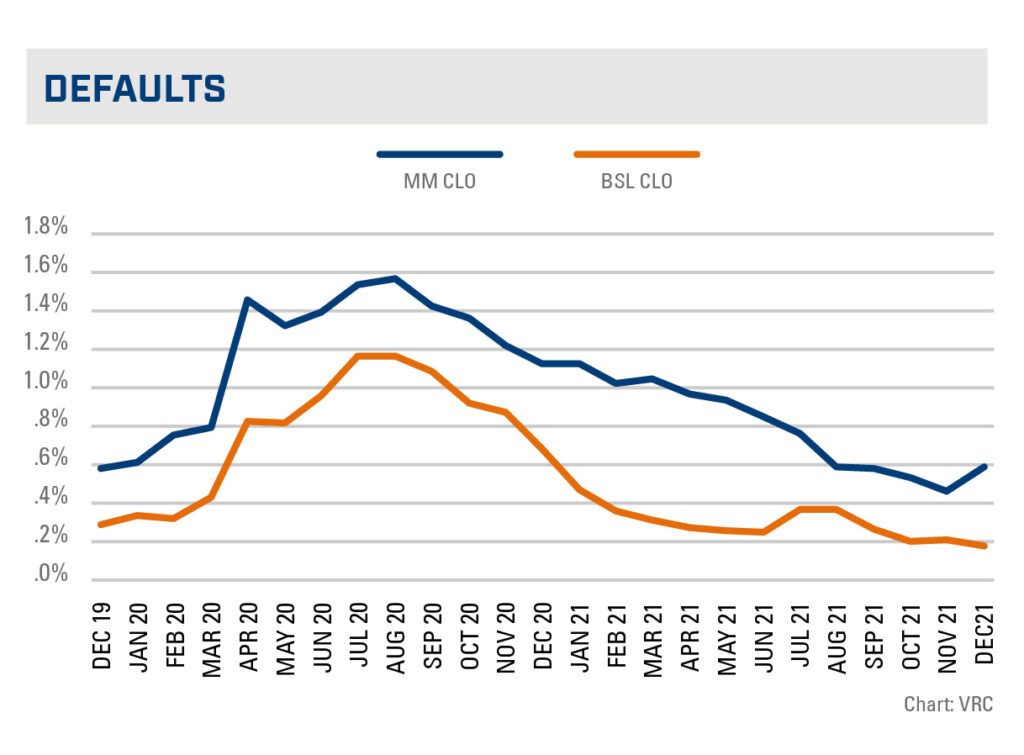

Nevertheless, MM CLOs did not sustain outsized rating shocks or default levels relative to BSL CLOs. Where BSL CLOs saw their allocations of CCC/Caa rated assets nearly triple, MM CLOs experienced a less severe increase on a relative basis and a similar increase (~10%) on an absolute basis. After the COVID crisis, pent-up consumer demand led to improved fundamentals and stronger balance sheets in 2021, which made many MM companies candidates for rating upgrades. Similar to rating actions seen in the BSL market, there were considerably more upgrades than downgrades of credit estimates in middle markets. For all of 2021, there were 142 upgrades compared to 108 downgrades.

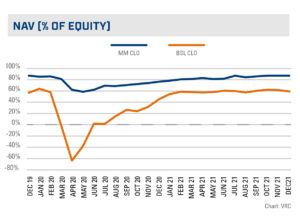

Similarly, MM CLOs did not sustain higher severity rates for those assets that did default, underscoring the robustness of middle-market assets in general. Additionally, due to the generally lower leverage level inherent in MM CLOs, MM CLO NAV (as a % of equity) outperformed BSL CLOs, as the greater loss cushion built into MM CLOs more than compensated for asset price declines.

In hindsight, although the onset of the pandemic caused many CLO managers and asset managers to become extremely cautious, the history and the data show that CLOs in general, and MM CLOs specifically, have continued to perform very well through various economic cycles and market shocks. Sufficient over-collateralization, strong covenant cushions, and generally risk-averse CLO portfolio composition for most new CLO issuances should allow CLOs to continue to perform strongly in any market environment.